It’s important for companies to use judgment and legal accounting methods when adjusting any accounts. The answer is yes, as long as it is done ethically and in compliance with accounting standards and regulations. Income smoothing involves strategically adjusting a company’s net income to create a more consistent and stable pattern of earnings over various reporting periods. In business, some periods witness high profits while others may experience low earnings. While it can appeal to investors, excessive income smoothing raises ethical concerns and may mislead stakeholders about a company’s proper financial health. When the truth about Enron’s accounting practices came to light, the company filed for bankruptcy, resulting in significant financial losses for investors and employees.

Corporate Finance Analysis

- The term refers to a wide range of good and bad practices such that it cannot be collectively termed as legal or illegal.

- Abnormal use of accruals, for example, might flag as suspicious accruals or as smoothing activity in fraud detection software.

- In some tax jurisdictions, a company might also be able to defer a large tax liability if current profits are moved to a future period.

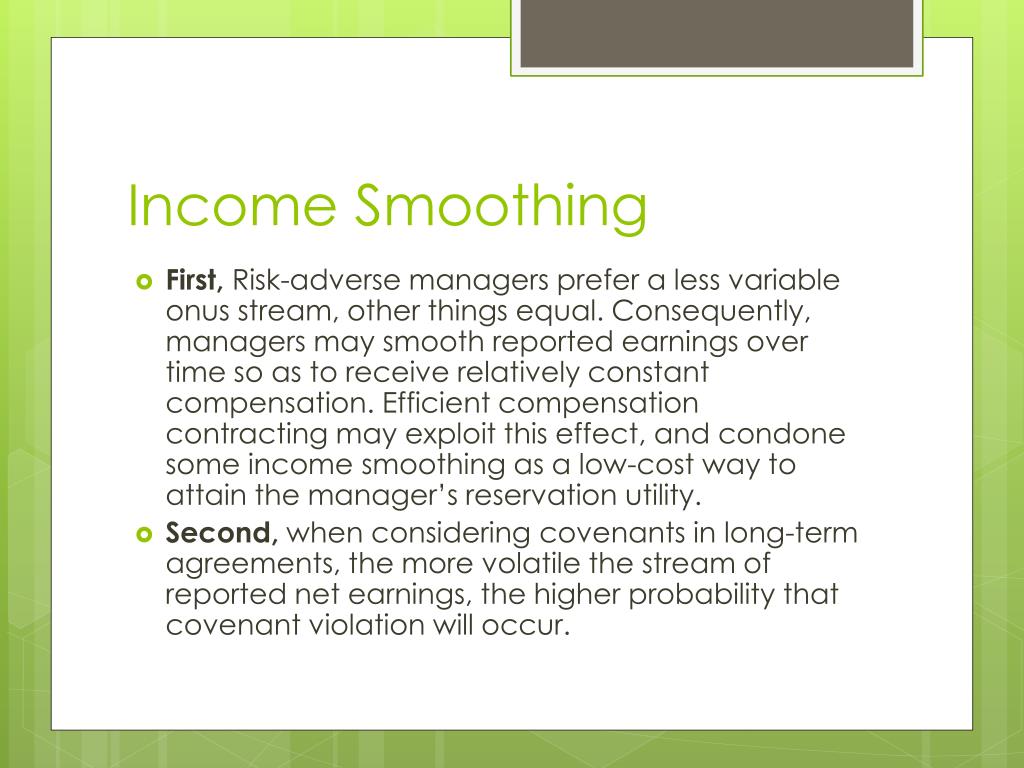

- In this view, shareholders will want managers to smooth earnings and compensate them accordingly.

- In a tough year, the company might reduce the allowance for doubtful accounts to reduce bad debt expense.

The Enron scandal led to increased scrutiny of income smoothing practices and prompted regulatory reforms to prevent similar incidents in the future. One common motivation is to avoid negative market reactions to fluctuations in earnings. By smoothing out the peaks and valleys in their financial performance, companies can present a more favorable image to investors and maintain a stable stock price.

Financial Literacy Matters: Here’s How to Boost Yours

Income smoothing is typically achieved by shifting revenue and expenses between periods. For example, a business may defer recognizing income in a profitable year to future years, or accelerate the recognition of expenses in a less profitable year. A business strategy a company can use when they have high profits is to increase expenses.

Income Smoothing: Definition, Legality, Process, and Example

This latter topic is inserted in a broader context that is those of earnings quality management. Moreover, this chapter explains the real earnings management policies such as income smoothing, big bath earnings management, and income minimization and income maximization policies. That warranty represents a future expense and it should accrue as an expense in the same reporting period in which the related product sales are recorded. Since companies that manipulate their accounts to artificially inflate earnings also use these techniques, sometimes it can be difficult to assess which is occurring. Abnormal use of accruals, for example, might flag as suspicious accruals or as smoothing activity in fraud detection software. A company might engage in smoothing to enable better strategic business management.

Timing of Revenue Recognition

Transparency and good communication with stakeholders are crucial in ensuring that income smoothing is seen as a legitimate financial management technique. Income smoothing is a financial strategy used by companies to stabilize their earnings over time, reducing the volatility of reported income. By manipulating accounting practices and timing of revenue and expense recognition, firms aim to present a more consistent financial performance, which can enhance investor perception and market stability. Hence, such a technique facilitates companies to curtail the impact of earnings volatility and portrays a stable profit picture, indicating a more predictable financial performance to the corporate stakeholders. Accountants often use their skills and knowledge to legally modify the revenues and expenses in such a way that the earnings look stable over consecutive reporting periods.

Related AccountingTools Courses

However, it is crucial to note that excessive manipulation or misrepresentation of financial statements can lead to ethical and legal concerns. Moreover, such changes in financial books should be performed under the permissible income smoothing describes the concept that practices of the Internal Revenue Service (IRS) to avoid regulatory non-compliance. Companies might also delay expenses in specific years with plans to raise funding from venture capital or private equity investors.

Aggressive income smoothing is regarded as unethical because it misrepresents a company’s true financial position to investors and creditors. Of course, income smoothing can be achieved by undertaking discretionary action. For example, in a year of low earnings, a company might eliminate jobs, defer maintenance or reduce R&D spending. In this view, shareholders will want managers to smooth earnings and compensate them accordingly. If a company expects sharply higher interest rates, deferring income and delaying tax payments can lower borrowing costs through the economic cycle.

So, for example, software companies receive annual prepayments for software which is used on a steady basis by customers. Rather than book the sale all at once, the company will normally treat it as a deferred revenue on the balance sheet and transfer the revenue each month. Accountants capitalize revenue to lower earnings and capitalize expenses to boost earnings. Items can be decapitalized at a future date as required, thus facilitating smoothing. Because it converts items on the income statement into balance sheet items, the process of deferral is frequently referred to as the capitalization of expenses or revenues.